tax saving strategies for high income earners canada

We will ensure we give you a high quality content that will give you a good grade. Contributions to these accounts dont reduce your taxable income for the year but distributions are tax-free.

Tax Strategies For High Income Earners 2022 Youtube

Combined income includes your adjusted gross income tax-exempt interest income and half of your Social Security benefits.

. Some actions -- such as remarrying working fewer than 35 years or working in a job in which your wages arent subject to Social Security tax --. One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions. Absolute poverty compares income against the amount needed to meet basic personal needs such as food clothing and shelter.

I could forsee a situation where an extreme early retiree could end up with a negative net income tax burden on a lifetime basis. We can handle your term paper dissertation a research proposal or an essay on any topic. This rate is almost always higher than the long-term capital gains tax rate of 15 or 20 for very high-income earners if you held the.

Poverty is the state of having few material possessions or little incomePoverty can have diverse social economic and political causes and effects. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Especially if you are high income pre-retirement.

A conclusion you could come to in that graph for MFJ is that if you have above average SS and a material amount of other income such as RMDs if you hit the hump 405 range at all it is for a. Then again nobody. From April 2010 the Labour government introduced a 50 income tax rate for those earning more than 150000.

Control the tax year for income and deductions Although do it now is excellent advice in nearly every situation when it comes to taxes there can be a benefit to carefully considering the. To get a better idea of the difference in tax payments between low- moderate- and high-income earners take a look at the 2018 tax payments by income level. On the other hand contributions to a tax-exempt account are.

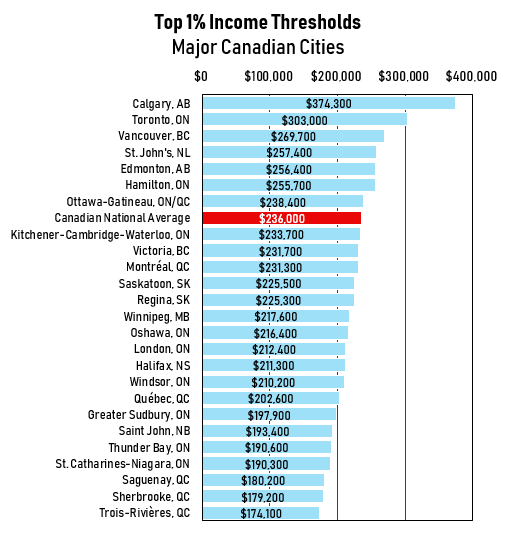

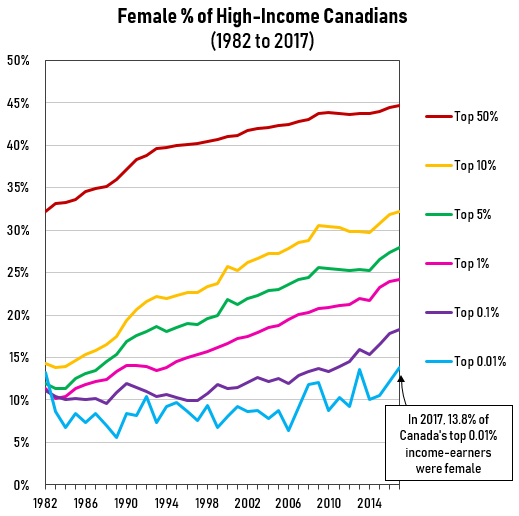

Income threshold for high taxation rate on. Whenever students face academic hardships they tend to run to online essay help companies. Income inequality has fluctuated considerably since measurements began around 1915 declining between peaks in the 1920s and 2007 CBO data or 2012 Piketty Saez Zucman dataInequality steadily increased from around 1979 to 2007 with a small reduction through 2016 followed by an increase from 2016 to 2018.

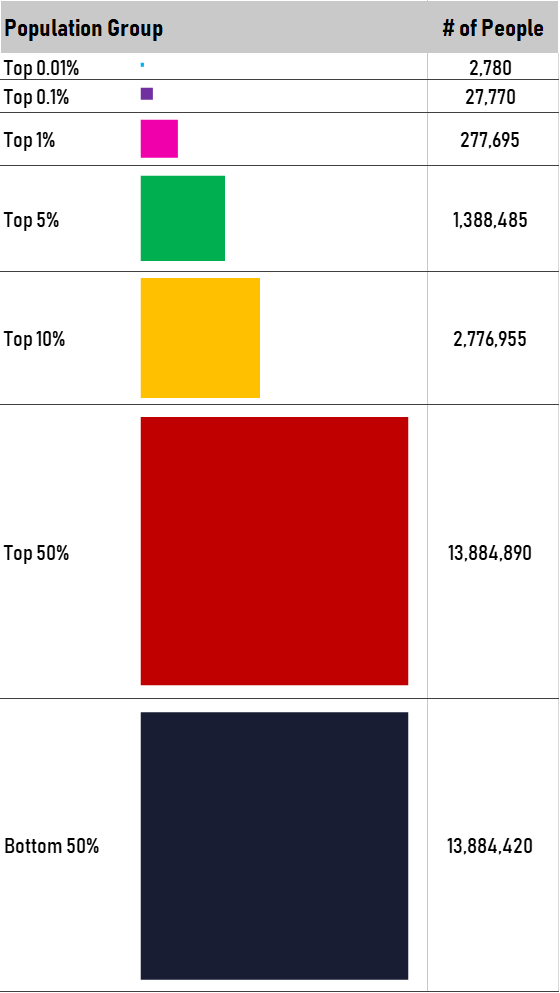

Use tax-advantaged accounts like a Roth IRA to reduce taxes on retirement income. Adjusted Gross Income Average Total. The Top 1 Income in Canada Salary of 232171 CDN per year.

Youll save more in taxes with a Roth 401k if youre in the same or a. You can currently. If this is also happening to you you can message us at course help online.

By retiring pre-65 and keeping withdrawls low you essentially game the system. That means high earners may be better off contributing to the traditional 401k and taking the tax deduction now at their high marginal tax rate than saving in a Roth account. To make it into the top 1 of income earners in Canada according to Statistics Canada requires a salary of 225409.

We will ensure we give you a high quality content that will give you a good grade. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Invest in low-cost index funds to generate higher long-term returns than cash.

So if you happen to. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Income tax is the single largest.

3 min read Aug 25 2022. Get all the latest India news ipo bse business news commodity only on Moneycontrol. In September 1997 this lower rate was reduced to 5 percent and was extended to cover various energy-saving materials from 1 July 1998.

This rate is lower than the personal income tax rate. Best time of the year to retire for tax purposes When you retire can potentially have a big impact on your retirement income and the taxes you owe. High earners can benefit from other accounts that offer current-year tax breaks and benefits that dont come with a Roth IRA.

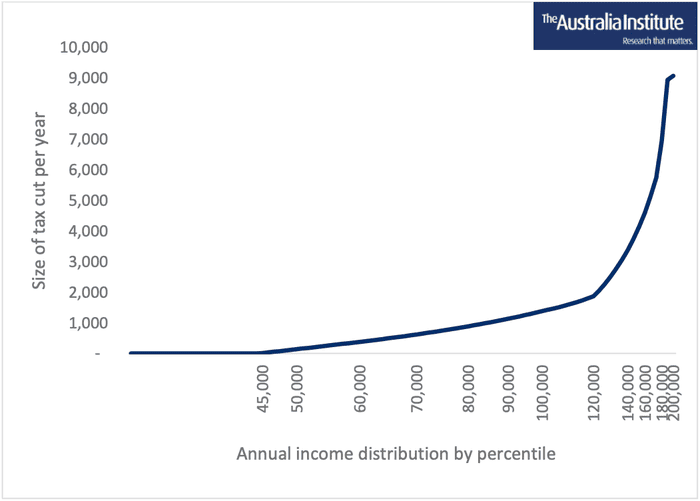

An early governmental measure that slightly reduced. Another set of studies and research shows that a mere 1 tax on the wealthy populations earnings can generate around 10 billion annually. The tax laws limit the usefulness of this strategy for shifting unearned income to children under age 18 but some tax-saving opportunities still exist.

We can handle your term paper dissertation a research proposal or an essay on any topic. Whenever students face academic hardships they tend to run to online essay help companies. If this is also happening to you you can message us at course help online.

Any unearned income over 2300 arising from UTMA accounts -- such as dividends interest and capital gains -- is taxed at the parents rate. There is currently a bill that if passed would increase the capital gains tax in Hawaii to 1100 and would also increase the states income tax. If those funds are withdrawn in five years when the person is in a higher tax bracket and pays a 32 income tax 320 will be paid out.

Agree that RRSPs are a fantastic tool for early retirees. When evaluating poverty in statistics or economics there are two main measures. Administration Building 130 High Street 2nd Floor - Hamilton OH 45011 Phone.

As with all retirement plans you cannot contribute more than you earned during the year so if you didnt earn at least 14000 from your employer your maximum contribution is.

How Do Taxes Affect Income Inequality Tax Policy Center

High Income Earners Need Specialized Advice Investment Executive

Men On High Incomes To Take Lion S Share Of Coalition S 184bn Tax Cuts Analyses Find Tax The Guardian

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How To Reduce Taxes For High Income Earners In Canada

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

Tax Planning For High Income Canadians Mnp

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Who Benefits More From Tax Breaks High Or Low Income Earners

How Do Taxes Affect Income Inequality Tax Policy Center